I was intrigued by “The XY Problem”

The XY problem is used by politicians on a regular basis – a kind of convoluted circular reasoning deception. They don’t want to answer or solve the X problem so they create or use an existing Y problem and solve that instead.

Justice must not only be seen to be done but has to be seen to be believed. That is if seeing is believing?

The Economy

The Economy

By far the most conspicuous example of this is the economy: What most people fail to understand (and this appears to include economists and the media) is that we have two economies: The first is the real economy that tends, if left to its own devices, to be quite stable. It is supported by those who manufacture value added goods from metal, plastic etc. and those who grow things using seeds and earth, not forgetting their service industries like transport for distribution, sales and others.

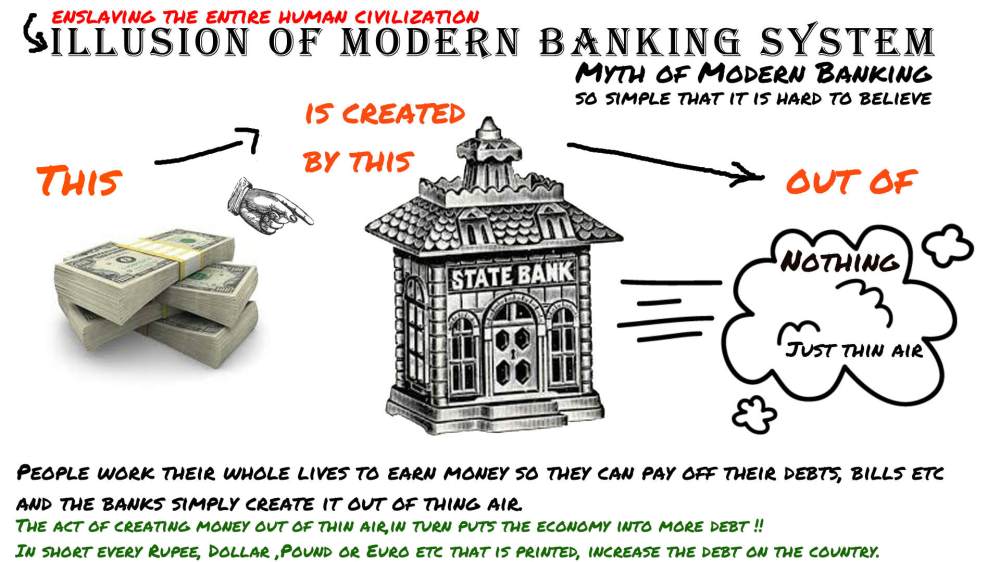

The second economy is the Ponzi or pyramid economy and this is the one we hear about on the media because it involves banks and investment. The Ponzi economy consists of banks who print money from thin air, money traders who buy and sell money that has no existence in reality, gold and silver traders who buy and sell gold that only exists on a computer screen, traders in mortgages and so on. It’s no coincidence that these people have 99% of all the money, they suck the life-blood from the real economy. They do nothing of benefit to society or the real economy, only enriching themselves.

Politicians tend to support the Ponzi economy because they are involved, either by directly profiting from it or they are in danger of loosing the support of those who do. They may be afraid of the press barons who can destroy their political careers, so they ignore the X problem, the real economy and go-along with the Y problem that looks good but does nothing for their constituents but make them poor.

Politicians tend to support the Ponzi economy because they are involved, either by directly profiting from it or they are in danger of loosing the support of those who do. They may be afraid of the press barons who can destroy their political careers, so they ignore the X problem, the real economy and go-along with the Y problem that looks good but does nothing for their constituents but make them poor.

And so, as a result of this, the only economy we hear about in the media is the Ponzi, the stock exchange, the value of the pound and so forth. The real economy that concerns and supports ordinary people is never mentioned. This is no secret, you can read about it on the Internet and watch it on YouTube, usually listed under conspiracy theory – ignored. How stupid can we all get?

The obvious answer to this is to make it illegal for anyone but the government to print money or create money from the air, but they will not do this because of the fear that someone will bring their sad careers to an end.

Wiki: “Austrian School economists such as Jesús Huerta de Soto and Murray Rothbard have also strongly criticized fractional-reserve banking, calling for it to be outlawed and criminalized. According to them, not only does money creation cause macroeconomic instability (based on the Austrian Business Cycle Theory), but it is a form of embezzlement or financial fraud, legalized only due to the influence of powerful rich bankers on corrupt governments around the world.[33][34] Politician Ron Paul has also criticized fractional reserve banking based on Austrian School arguments.[35]” https://en.wikipedia.org/wiki/Fractional-reserve_banking

How Banks Create Money From Thin Air

financialsense.com: “Let’s walk through a hypothetical example to show how the act of bank lending creates new money. Say that person A has $100 dollars in cash and decides to deposit this money into a bank. The bank has a reserve ratio of 10%, and so it must keep $10 in reserves but can loan out the other $90. Let’s say the bank makes a $90 loan to person B.

Time to stop and recap what just happened. Person A originally had $100 cash and consequently $100 worth of purchasing power. When person A deposits this money into a bank, they still have $100 in purchasing power. The bank then loaned out the $90 that it was not required to hold as reserves and this money went to person B. Now person B has $90 worth of purchasing power, and person A still has $100 of purchasing power. Money was just created.

In the micro economy of our example, $100 in original purchasing power has just turned into $190 worth of purchasing power. The amount of money in the economy that is able to chase goods and services just increased as a result of bank lending.

Taking this forward another step, let’s say person B pays this $90 to person C, who then deposits it into a bank. This could be the same bank or a different one, it doesn’t matter. The bank must keep $9 of this new deposit (remember 10% of $90 is $9) and can loan out the remaining $81. If the bank lends out the $81, the money supply in the economy grows again. What started as $100 that was available to chase goods and services has grown into $271 of purchasing power ($100 + $90 + $81) …” http://www.financialsense.com/contributors/matthew-kerkhoff/fractional-reserve-banking-how-to-create-destroy-money

If you want to solve the crime, follow the money.

Yes, that’s how it works! (Or doesn’t work!)

LikeLike